irs child tax credit tool

The administration has reluctantly concluded that it cannot allow them to use the portal to claim billions in child payments now. Here is some important information to understand about this years Child Tax Credit.

Summary Of Eitc Letters Notices H R Block

The tool was created in order to help those who do not ordinarily owe federal income taxes register for the child tax credit.

. Finance tax. Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. Eligible families who already filed or plan to file 2019 or 2020 income tax returns.

Enter Payment Info Here tool in 2020 to qualify for advance payments of the Child Tax Credit. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. IR-2021-130 June 22 2021.

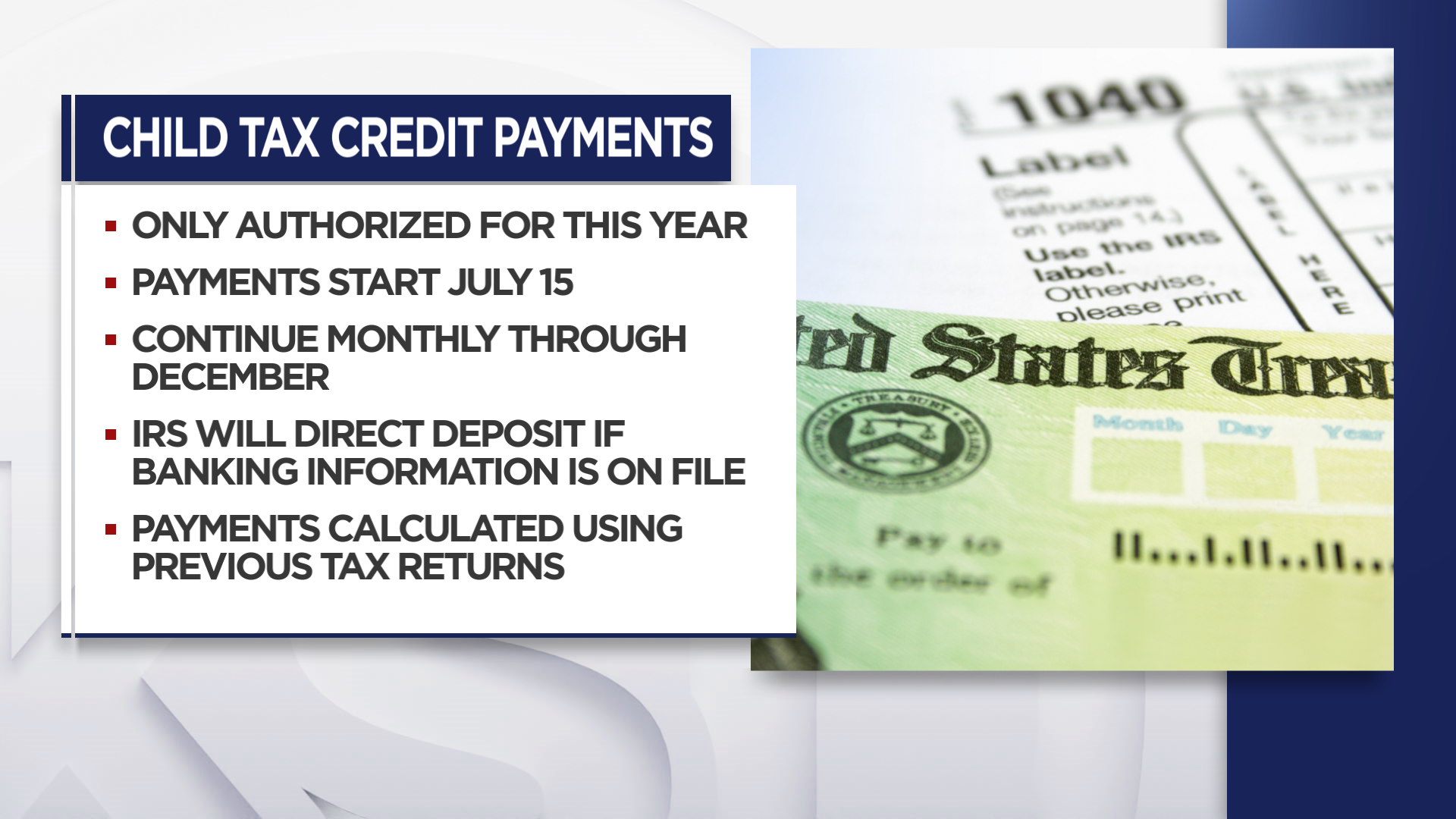

You will claim the other half when you file your 2021 income tax return. It helps you prepare accurate returns practice due diligence and get your clients the credits they are due. The IRS will pay half the total credit amount in advance monthly payments.

Do not use the Child Tax Credit Update Portal for tax filing information. IRS Freezes Tool for Child Tax Credit Payments. File a free federal return now to claim your child tax credit.

Update Portal helps families monitor and manage Child Tax Credit payments. That means parents who. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

Tax Season Madness. It also made the. The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments.

IRS unveils online tool to help low-income families register for monthly Child Tax Credit payments No action needed by most families. This tool can be used to review your records for advance payments of the 2021 Child Tax Credit. IR-2021-150 July 12 2021.

Advance Child Tax Credit Eligibility Assistant. The Child Tax Credit provides money to support American families. If you had total income in 2020 below those levels you can sign up to receive monthly Child Tax Credit payments using simple tool for non-filers developed by the non-profit Code for America.

WASHINGTON The Internal Revenue Service today launched two new online tools designed to help families manage and monitor the advance monthly payments of Child Tax Credits under the American Rescue Plan. The 2021 Advance Child Tax Credit is fully refundable meaning that. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

To complete your 2021 tax return use the information in your online account. This toolkit has everything you need to help you with claims for the earned income tax credit child tax creditadditional child tax creditcredit for other dependents and American opportunity tax credit. Fearing filing season chaos IRS hits pause on web tool for Child Tax Credit The decision has disappointed some advocates for low-income people who fear it will mean some will face.

WASHINGTON The Internal Revenue Service has launched a new Spanish-language version of its online tool Child Tax Credit Eligibility Assistant designed to help families determine whether they qualify for the Child Tax Credit and the special monthly advance payments of the credit due to begin on July 15. The tool then walks users through a set of questions beginning with whether the taxpayer claimed the child tax credit on their 2019 or 2020 return and whether they have established residency in. Who is Eligible.

Ad The new advance Child Tax Credit is based on your previously filed tax return. You must have claimed the Child Tax Credit on your most recent tax return or gave us information about your qualifying children in the Non-Filers. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

These two new tools are in addition to the. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. Enter Payment Info Here tool or.

To file a tax return and become eligible see Non-filer Sign-up tool.

Pin By Vann Ferguson On Finances In 2022 Tax Refund Income Tax Return Child Tax Credit

Irs Child Tax Credit Payments Start July 15

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

Irs Has Sent 6 Billion In Stimulus Payments Just In June Here S How To Track Your Money Irs Prepaid Debit Cards How To Get Money

2021 Child Tax Credit Advanced Payment Option Tas

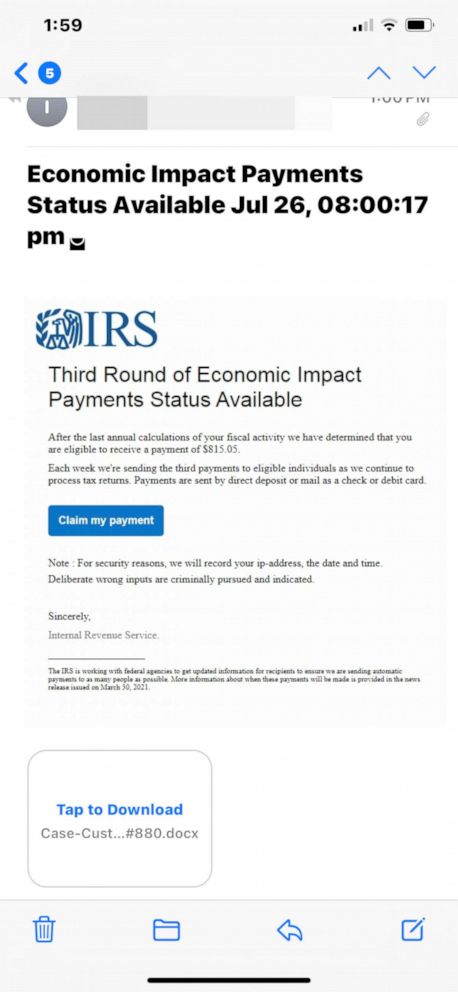

Irs Warns Of Child Tax Credit Scams Abc News

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Capture This 2 500 College Tax Credit The College Solution Tax Credits Tax Debt Debt Forgiveness

The New 3 600 Child Tax Credit Watch For Two Letters From The Irs Wbff

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information

Irs Sending Letters To Advance Child Tax Credit Recipients Cpa Practice Advisor

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Stimulus Latest Here S What You Can Do If You Got The Wrong Child Tax Credit Amount